A. Do you want to start foreign company?

Any foreign company can establish its place of business in India by filling Form 44 (Documents delivered for registration by a foreign company). The eForm has to be digitally signed by authorized representative of the foreign company

There is no need to apply and obtain DIN for Directors of a foreign company but the DSC of the authorized representative is mandatory, which again is not required to be registered on MCA Application

B. Do you want to start Indian company?

1. PROCEDURE

To register a company, you need to first apply for a Director Identification Number (DIN) which can be done by filing eForm for acquiring the DIN. You would then need to acquire your Digital Certificate and register the same on the portal. Thereafter, you need to get the company name approved by the Ministry. Once the company name is approved, you can register the company by filing the incorporation form depending on the type of company.

Step1 Application for DIN

The concept of a Director Identification Number (DIN) has been introduced for the first time with the insertion of Sections 266A to 266G of Companies (Amendment) Act, 2006. As such, all the existing and intending Directors have to obtain DIN within the prescribed time-frame as notified.

You need to file eForm DIN-1 in order to obtain DIN. To get more information about the same click Director Identification Number .

Step 2 Acquire/ Register DSC

The Information Technology Act, 2000 provides for use of Digital Signatures on the documents submitted in electronic form in order to ensure the security and authenticity of the documents filed electronically. This is the only secure and authentic way that a document can be submitted electronically. As such, all filings done by the companies under MCA21 e-Governance programme are required to be filed with the use of Digital Signatures by the person authorised to sign the documents

Acquire DSC -A licensed Certifying Authority (CA) issues the digital signature. Certifying Authority (CA) means a person who has been granted a license to issue a digital signature certificate under Section 24 of the Indian IT-Act 2000

Register DSC -Role check for Indian companies is to be implemented in the MCA application. Role check can be performed only after the signatories have registered their Digital signature certificates (DSC) with MCA. To know about it click Register a DSC.

Step 3 New User Registrations

To file an eForm or to avail any paid service on MCA portal, you are first required to register yourself as a user in the relevant user category, such as registered and business user. To register now click New User Registration.

Step 4 Incorporate a Company

Apply for the name of the company to be registered by filing Form1A for the same. After that depending upon the proposed company type file required incorporation forms listed below

- Form 1: Application or declaration for incorporation of a company

- Form 18: Notice of situation or change of situation of registered office

- Form 32: Particulars of appointment of managing director, directors, manager and secretary and the changes among them or consent of candidate to act as a managing director or director or manager or secretary of a company and/ or undertaking to take and pay for qualification shares

Once the form has been approved by the concerned official of the Ministry, you will receive an email regarding the same and the status of the form will get changed to Approved. To know more about eFiling process click “All About eFiling”.

2. OUR SERVICES

We’ve prepared the ideal package of services for the company type listed above to help you start your business in India. In order to make the process go as smoothly as possible, we’ve prepared a limited list of necessary documents we’ll need so that we can prepare all the rest for you. If you have any questions about these please don’t hesitate to ask.

Opening Foreign/Indian Company

Establishing a corporation is a big step toward business development and expansion, whether it is done in India or outside. It calls for meticulous preparation, adherence to the law, and in-depth knowledge of the registration procedure. Understanding the intricacies of company creation is essential, regardless of whether you’re an Indian firm aiming to expand internationally or a foreign organization seeking to establish a presence in India.

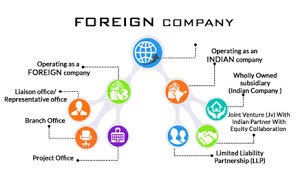

Types of Companies You Can Open In India :-

Small to medium-sized firms benefit greatly from private limited companies (Pvt. Ltd.), which provide limited liability and provide simple access to capital.

Public Limited Company: Ideal for bigger companies looking to raise money through government investments.

With limited responsibility for partners, a limited liability partnership (LLP) combines the features of a firm and partnership.

For international businesses looking to investigate Indian markets without establishing a full-fledged corporation, a branch office or liaison office is ideal.

One Person Company (OPC): A more straightforward business model for solo proprietors.

Abroad (Foreign Companies):

Choose a Business Structure: Decide on the type of company based on your business goals.

Obtain Digital Signature Certificate (DSC): For electronic filings with the Ministry of Corporate Affairs (MCA).

Apply for Director Identification Number (DIN): Required for directors of the company.

Reserve Company Name: Through the MCA’s portal.

Draft Memorandum of Association (MOA) & Articles of Association (AOA): Define the company’s objectives and operational rules.

Incorporation Filing: Submit necessary documents to the MCA.

PAN & TAN Application: Essential for taxation purposes.

Bank Account Opening: For the company’s financial transactions.

For Foreign Companies:

Recognize Local Laws: Foreign investments and business establishment are subject to specific laws in each nation.

Pick a Business Entity: Decide on the best organizational form (branch office, subsidiary, etc.).

Register the Business: Submit paperwork to the appropriate government in the country of residence.

Registration for Taxes: As needed, get tax identification numbers.

Respect foreign exchange regulations: Respect FEMA (in India) or comparable laws in other nations.

Local Partnerships: For more efficient operations, work with local organizations, if necessary.

Key Steps in Company Formation :-

For Indian Companies:

Select a Business Structure: Depending on your company’s objectives, choose the right kind of business.

Acquire a Digital Signature Certificate (DSC) in order to submit electronic documents to the Ministry of Corporate Affairs.

Get a Director Identification Number (DIN) by applying: required of the company’s directors.

Reserve Company Name: Via the MCA website.

Draft Articles of Association (AOA) and Memorandum of Association (MOA): Specify the goals and regulations of operation of the business.

Incorporation Filing: Send the required paperwork to the MCA.

Application for PAN & TAN: Required for taxes.

Opening a bank account: For financial operations involving the business.

For Foreign Companies:

Understand Local Laws: Each country has unique regulations for foreign investments and business formation.

Select a Business Entity: Choose the appropriate structure (subsidiary, branch office, etc.).

Register the Business: File documents with the relevant authority in the host country.

Tax Registration: Obtain tax identification numbers as required.

Comply with Foreign Exchange Laws: Adhere to FEMA (in India) or similar regulations in other countries.

Local Partnerships (if needed): Collaborate with local entities for smoother operations.

Why Choose Global CA?

Expert Advisory: We offer end-to-end guidance, from entity selection to incorporation and compliance.

Legal Compliance: Assistance in meeting regulatory requirements, such as FEMA for foreign companies in India.

Tax Planning: Optimizing tax structures to reduce liabilities and enhance profitability.

Custom Solutions: Tailored services based on the client’s industry, goals, and geographical focus.

Global Network: Extensive experience in setting up businesses across multiple jurisdictions